Debt Consolidation

Debt consolidation is the ideal strategy to regain control of multiple debts while saving money by replacing high interest debt with a low interest loan. Consolidating your debt also makes managing your finances easier as you will only have to manage a single loan from a single institution.

Here’s how it works.

You take out a new loan that is large enough to pay off the principal balance of all the debts you want to consolidate, typically all those that have a higher interest rate than the new loan. Once approved and the funds are relinquished, you immediately pay off all the original debts. This effectively replaces your current debt with new debt, but at a lower interest rate. Note that debt consolidation never removes any of your debt, it simply bundles it all together at a lower interest rate. It’s the lower interest rate that ends up saving you money.

Example

Say Fiona has four different debt products: two credit cards, a department store card, and a personal loan. Each currently has a balance of $2,500 for a total debt of $10,000. Each of her products has a different interest rate. Her credit cards each have an interest rate of 19.9%, her department store card has an interest rate of 29.9%, and her personal loan has an interest rate of 8%.

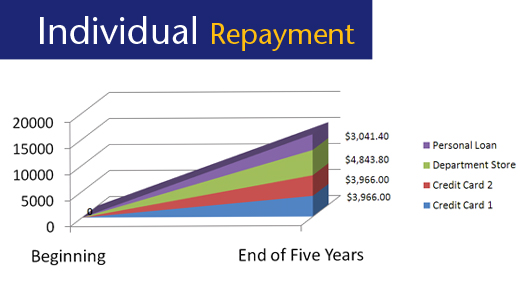

To pay off all four debts in the next five years individually, Fiona would have to make a total of $263.62 in monthly payments. That consists of $66.10 per month for each of the credit cards, $80.73 per month for the department store card, and $50.69 per month for the personal loan. Once paid off, Fiona would have paid a total of $15,817.20 ($10,000 to repay the principal balances and $5,817.20 in interest).

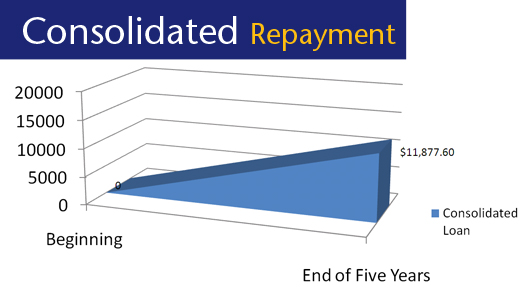

If Fiona were to consolidated all four debt products into a $10,000 consolidation loan at 6.99%, her new monthly payment will be $197.96. At the end of the five years, Fiona would pay a total of $11,877.60 ($10,000 to repay the principal and $1,877.60 in interest).

Comparing Fiona’s payment on the consolidation loan to the sum of the individual payments of the individual debts, Fiona saves $65.66 per month. Once the loan is paid off, Fiona would have only spent $1,877.60 in interest with the consolidation loan versus $5,817.20 if she did not consolidate her debt.

Fiona’s savings is coupled with the simplicity of dealing with only one payment instead of four each month. This also means that Fiona only has to deal with one organization if there is ever a problem.

Debt Consolidation saves you money and time by streamlining your debt repayment plan. Speak to one of our lending specialists today to learn more about how consolidating your debt can save you more on your financing.